What is RPLI?

Rural Postal Life Insurance (RPLI) is life insurance offered to the rural populace of India with a ”Low premium and High bonus” and extends insurance cover to people living in rural areas with special emphasis on weaker sections and women workers.

Rural Postal Life Insurance(RPLI) has been introduced in the year 24-03-1995 for the benefit of the rural populace.

RPLI – Maximum Sum Assured has been enhanced from Rs 3 Lakhs to Rs 10 Lakhs w.e.f. 13-05-2017. Earlier, the maximum sum assured used to be Rs 3 Lakhs w.e.f 01-03-2007 to 12-05-2021.

PLI-Maximum Sum Assured has been enhanced from Rs 20 Lakhs to Rs 50 Lakhs w.e.f. 10-09-2021.

Types of RPLI Policies

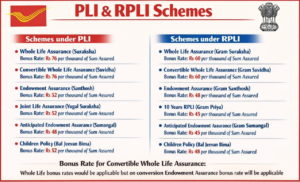

RPLI offers the following Six (6) types of policies:

(i) Whole Life Assurance (Gram Suraksha)

(ii) Endowment Assurance (Gram Santosh)

(iii) Convertible Whole Life Assurance (Gram Suvidha)

(iv) Anticipated Endowment Assurance (Gram Sumangal)

(v) 10 Year RPLI (Gram Priya/Dasa Varsha)

(vi) Children Policy (Bal Jeevan Bima)

Details of Rural Postal Life Insurance (RPLI) Plans

| SLNO | RPLI Policy | Other Name | Bonus Rate per ₹1,000 Sum Assured as of 01-04-2020 to now |

| 1. |

Whole Life Assurance (WLA)Age: 19-55 years Min=₹10,000; Max=₹ 10Lakhs Loan: after 4 years Surrender: 3 years |

Gram Suraksha |

₹ 65 |

| 2. |

Endowment Assurance (EA)Age: 19-55 years Min=₹10,000; Max=₹ 10Lakhs Loan: after 3 years Surrender: 3 years |

Gram Santosh |

₹50 |

| 3. |

Children PolicyParent Age: 19-45 Child Age: 5-20 years Min=₹10,000; Max=₹ 1 Lakh or equal to the sum assured of the parent, whichever is less. Loan: No Loan

|

Bal Jeevan Bima Policy |

₹50 (EA Bonus will be given as ONLY Endowment policy can be taken here) |

| 4. |

Convertible Whole Life Assurance(CWLA) Age:19-50 years Min=₹10,000; Max=₹ 10 Lakh

|

Gram Suvidha | ₹ 65 if not converted to EA or ₹50 if converted to EA |

| 5. | Anticipated Endowment Assurance (AEA)Age:19-45 for 15 yrs Term Policy

19-40 for 20yrs-Term Policy Min=₹10,000; Max=₹ 10Lakhs Loan: No Loan Surrender: No Surrender possible |

Gram Sumangal |

₹47 |

| 6. | 10 Year RPLI Policy(Dasa Varsha or

Grameena Dak Jeevan Bima Yojana)Age: 19-45 years Min=₹10,000; Max=₹ 10Lakhs Loan: No Loan Surrender: No Surrender possible |

Gram Priya RPLIMoney Back Policy with periodicity: 4 years=20% of SA 7 years=20% of SA 10 years=60% of SA+ Bonus accrued for 10 years |

₹47 |

RPLI Benefits

RPLI Benefits are many folds.

1. RPLI Premium is exempt from Income Tax under section 80(C) to an overall ceiling of 1.50 Lakhs per annum including other schemes. In other words, Deduction under Section 80C for the premiums paid as per the Income Tax Act, 1961 with the maximum limit of deduction under section 80C is Rs 1.50 lakh.

2. Provides for Insurance with Low -premium and High Bonus.

3. You can pay RPLI Premium at any nearby Post office. Also, you can pay the RPLI policy premium through any post office across India.

4. There is a 100% security offered by the Government of India.

5. Rebate: 1% rebate is offered for payment of 6 months’ premiums in advance.

6. Rebate: 2% rebate is offered for payment of 12 months’ premiums in advance.

7. Rebate: Rebate of Re1- per every Rs20,000 Sum Assured of RPLI policy is allowed.

8. The insurance policy can be easily transferred to any place in India.

RPLI-Important Points to remember:

1. The maximum limit of sum assured with Non-Standard proof of age in RPLI shall be Rs One lakh.

2. The 5% extra premium will be loaded and policies with a sum assured of more than Rs 25,000/- should be subject to a usual medical examination.

3. Also, anyone taking policies worth or more than Rs 25,000/- (sum assured) with non-standard proof of age shall not be beyond 45 years of age.

4. The maximum limit in respect of the non-medical scheme, taking the total sum assured together under all RPLI plans shall not exceed Rs 25,000.