What is PLI?

Postal life insurance (PLI) is similar to insurance plans offered by other insurance companies such as LIC (Life Insurance Corporation of India). PLI is a contract entered into by the government to pay a given sum of money on the death of an insured to his nominee or himself, if he survives that period. PLI is a good option for people, who are ‘eligible’ for it, as it charges lower premiums and offers higher returns than comparable policies of life insurers. Postal Life Insurance was introduced on 1st February, 1884

Features

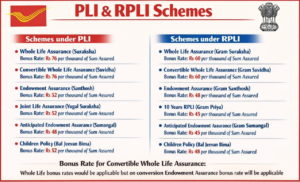

PLI offers the following six types of policies:

- Whole Life Assurance (Suraksha)

- Endowment Assurance (Santosh)

- Convertible Whole Life Assurance (Suvidha)

- Anticipated Endowment Assurance (Sumangal)

- Joint Life Assurance (Yugal Suraksha)

- Children Policy(Bal Jeevan Bima)

PLI policies:

1. Whole Life Assurance (Suraksha)

This is a scheme where the assured amount with accrued bonus is payable to the insured either on attaining the age of 80 years, or to his/her legal representatives or assignees on death of the insured, whichever occurs earlier, provided the policy is in force on the date of claim.

- Minimum & Maximum age at entry: 19-55 years

- Minimum Sum Assured ₹ 20,000; Maximum ₹ 50 lac

- Loan facility after 4 years

- Surrender after 3 years

- Not eligible for bonus if surrendered before 5 years

- Can be converted into Endowment Assurance Policy upto 59 years of age of the insurant provided the date of conversion does not fall within one year of the date of cessation of premium payment or date of maturity.

- Premium paying age can be opted for as 55,58 or 60 years

- Proportionate bonus on reduced sum assured is paid if policy is surrendered

- Last declared Bonus- ₹ 85/- per ₹ 1000 sum assured per year

2. Endowment Assurance (Santosh)

Under this scheme the proponent is given an assurance to the extent of the sum assured and accrued bonus till he/she attains the pre- determined age of maturity i.e 35,40,45,50,55,58 & 60 years of age.

- In case of death of insurant, assignee, nominee or legal heir is paid full amount of sum assured with accrued bonus

- Minimum & maximum age at entry: 19-55 years

- Minimum sum assured ₹ 20,000; Maximum ₹ 50 lac

- Loan facility after 3 years

- Surrender after 3 years

- Not eligible for bonus if surrendered before completion of 5 years

- Proportionate bonus on reduced sum assured is paid if policy is surrendered after 5 years

- Last declared Bonus – ₹ 58/- per ₹ 1000 sum assured per year

3. Convertible Whole Life Assurance (Suvidha)

A Whole Life Assurance Policy with the added feature of an option to convert to Endowment Assurance Policy at the end of five years of taking policy.

- Assurance to the extent of sum assured with accrued bonus till attainment of maturity age

- In case of death, assignee, nominee or legal heir paid full amount of sum assured with accrued bonus

- Minimum age & Maximum age at entry: 19-50 years

- Can be converted into Endowment Assurance after 5 years not later than 6 years of taking policy. If not converted, policy will be treated as Whole Life Assurance

- Minimum sum assured ₹ 20,000; Maximum ₹ 50 lac

- Loan facility after 4 years

- Surrender after 3 years

- Not eligible for bonus if surrendered before completion of 5 years

- Last declared Bonus- ₹ 85/- per ₹ 1000 per year (for WLA policy if not converted to Endowment Assurance)

- On conversion, bonus of Endowment Assurance will be payable.

4.Anticipated Endowment Assurance (Gram Sumangal)

It is a Money Back Policy with maximum sum assured of ₹ 10 lacs, best suited to those who need periodical returns. Survival benefits are paid to the insurant periodically. Such payments will not be taken into consideration in the event of unexpected death of the insurant. In such cases, full sum assured with accrued bonus is payable to the assignee, nominee of legal heir.

- Policy term: 15 years and 20 years

- Minimum age 19 years; maximum age at entry 40 years for 20 years’ term policy & 45 years for 15 years’ term policy

- Survival benefits paid periodically as under: –

- 15 years Policy- 20% each on completion of 6 years, 9 years & 12 years and 40% with accrued bonus on maturity

- 20 years Policy- 20% each on completion of 8 years, 12 years & 16 years and 40% with accrued bonus on maturity

- Last declared Bonus- ₹ 47/- per ₹ 1000 sum assured per year

5. Joint Life Assurance (Yugal Suraksha)

It is a Joint Life Endowment Assurance in which one of the spouses should be eligible for PLI policies.

- Life cover to both spouses to the extent of sum assured with accrued bonus with a single premium

- Minimum sum assured ₹ 20,000; Maximum ₹ 50 lac

- Minimum age & Maximum age at entry of spouses: 21-45 years

- Maximum Age of the elder policy holder should not be more than 45 years & the couple should be between 21 years to 45 years

- Minimum term of policy 5 years and maximum 20 years

- Loan facility after 3 years

- Surrender after 3 years

- Not eligible for bonus if surrendered before completion of 5 years

- Proportionate bonus on reduced sum assured is paid if policy is surrendered

- Death benefits are paid to either of the survivors in the event of death of spouse or main policy holder

- Last declared Bonus- ₹ 58/- per ₹ 1000 sum assured per year

6. Children Policy (Bal Jeevan Bima)

The salient features of this scheme are as under:

- The scheme provides life insurance cover to children of policy holders.

- Maximum two children of policy holder (parent) are eligible

- Children between 5- 20 years of age are eligible

- Maximum sum assured ₹ 3 lac or equal to the sum assured of the parent, whichever is less

- Policy holder (parent) should not be over 45 years of age.

- No premium to be paid on the Children Policy, on the death of policy holder (parent). Full sum assured and bonus accrued shall be paid on completion of term

- Policy holder (parent) shall be responsible for payment of Children policy

- No loan admissible

- Has facility for making it paid up, provided premiums are paid continuously for 5 years

- Surrender facility is not available

- No medical examination of child necessary. However, child should be healthy and risk shall start from day of acceptance of proposal

- Attract the rate of bonus applicable for Endowment policy (Santosh) i.e. last bonus rate is ₹ 58/- per ₹ 1000 sum assured per year.